Status of 2018 China Metal Injection Molding

Metal Injection Molding in China

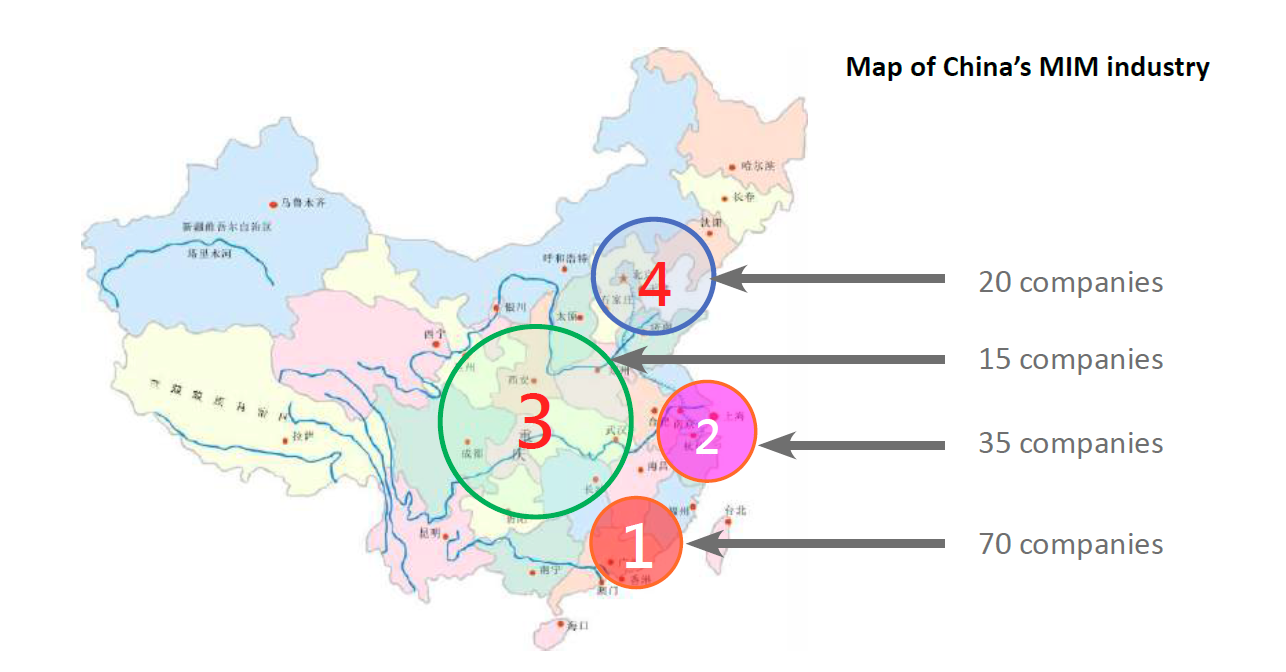

Metal Injection Molding has rapidly grown in China over the past decade. There are over 140 MIM companies in mainland China, a number of MIM operations were established in the Zhujiang Delta industrial zone where many of the products for the world’s leading electronics OEMs such as Huawei, Lenovo, Apple and Samsung are manufactured. This gave ready access to a fast growing market for 3C MIM parts, particularly for use in smartphones. The regional distribution of MIM companies in China is shown in Fig. 1.

Fig. 1 Distribution of the main MIM manufacturing plants in China

A dynamic market driven by consumer electronics

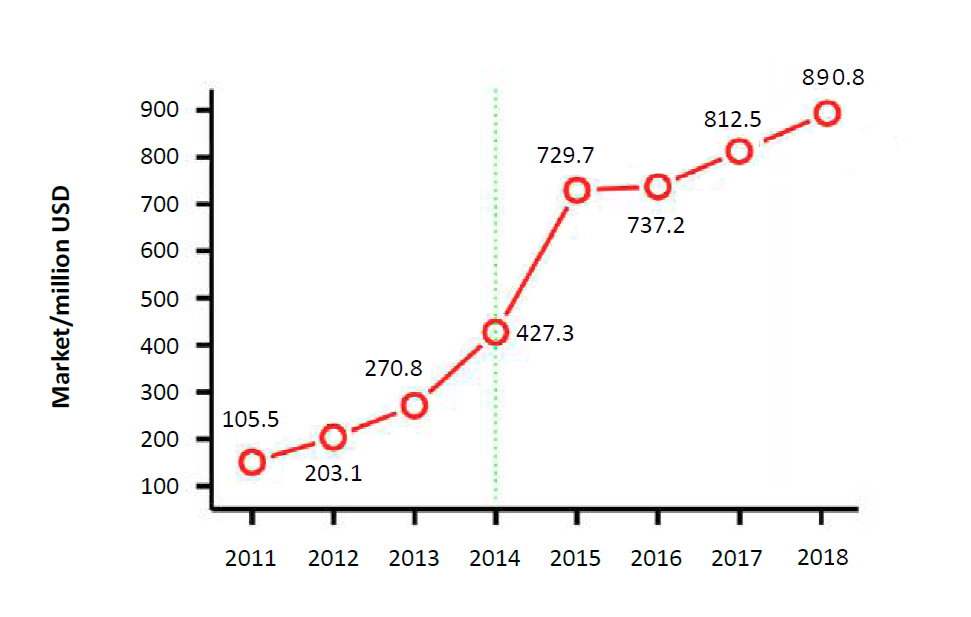

Fig. 2 MIM part sales have grown rapidly in China since

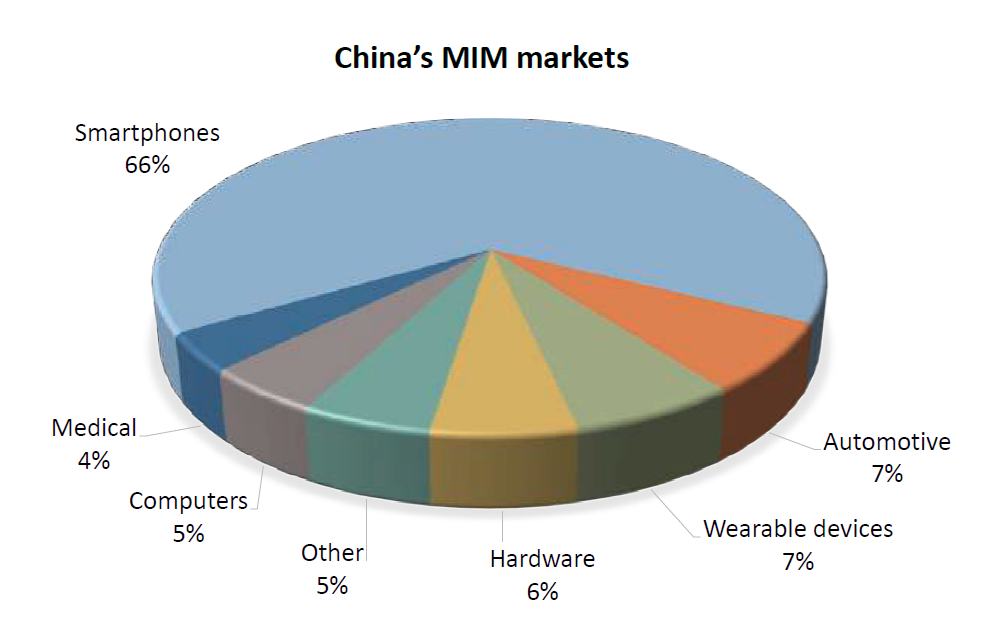

Fig. 2 shows sales growth for the MIM industry in China since 2010. Sales of MIM parts were said to have reached $890 million in 2018. In terms of the breakdown of materials used, stainless steels account for 70% of production, low-alloy steels 20%, tungsten-based materials 8% and other materials 2%. Fig. 3 shows the breakdown of applications, with smartphones accounting for 66% of the MIM market in China.

Fig. 3 Breakdown of MIM application areas in China

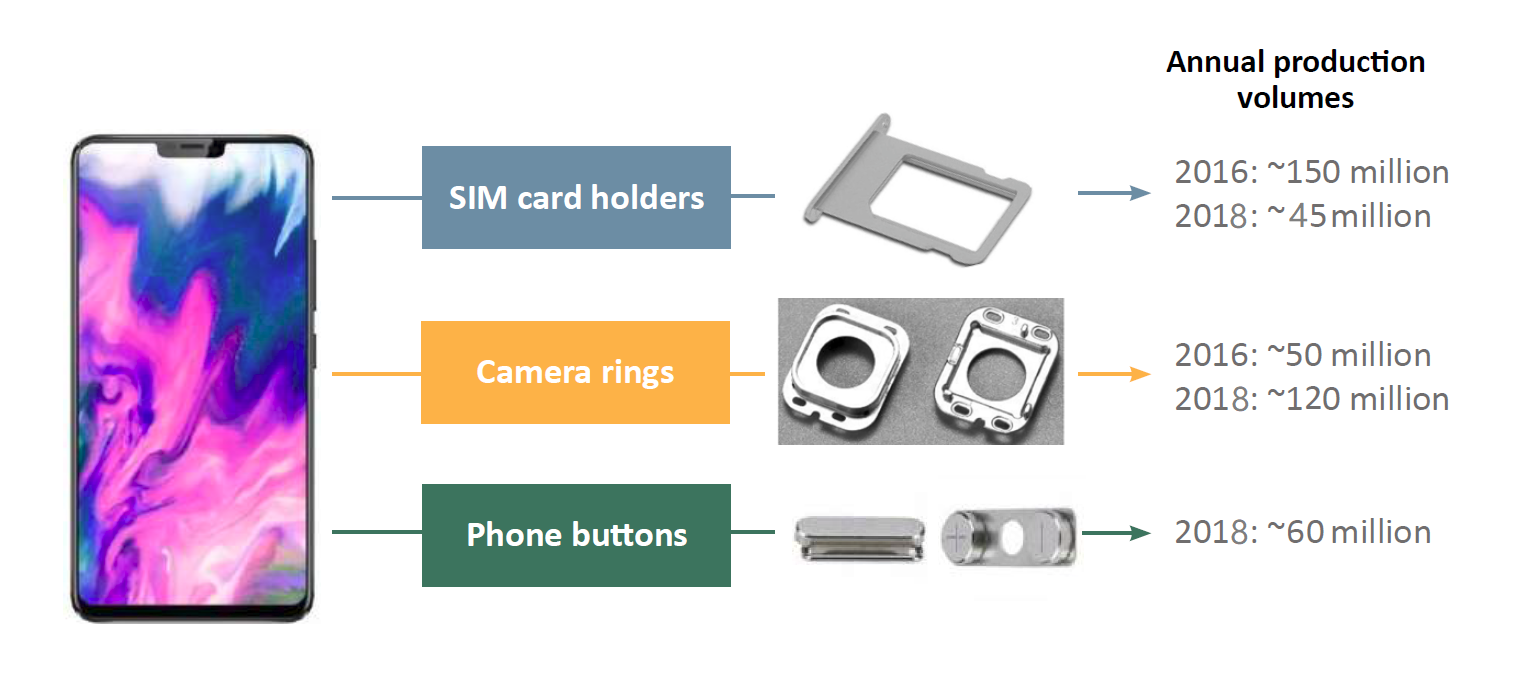

The main MIM products in smartphones are SIM card holders, their production fall from 150 million pieces in 2016 to 45 million pieces in 2018, camera rings, of which 120 million were produced in 2018, and phone buttons, which reached 60 million pieces in 2018. (Fig. 4)

Fig. 4 Key MIM parts produced in China that are used in smartphones

Growth in Chinese MIM materials and production equipment

Chinese powder manufacturers and equipment suppliers made the important contributions in helping to meet the increasing demand from the ever growing number of Chinese MIM producers.

Around 80% of feedstock is produced in-house by MIM manufacturers. There are also a growing number of companies in China supplying MIM feedstock, however BASF remains by far the largest feedstock producer. There is a heavy reliance on polymer-base binders for MIM feedstock in China, which provide the strength and precision required for MIM part production. R&D efforts are also underway in China to develop MIM feedstock with lower shrinkag rates to minimise distortion during debinding and sintering, hybrid debinding technologies to reduce debinding time in MIM part production, and feedstock which can be used for both MIM and MIM-like Additive Manufacturing processes.

A significant proportion of production equipment used by China Metal Injection Molding companies, such as advanced injection molding machines, specialised debinding furnaces and continuous debinding/sintering furnaces are now available from Chinese producers.

Outlook

Although Metal Injection Molding is now regarded as an established manufacturing process, MIM technology still has a promising and bright future in areas such as automotive, medical, energy (fuel cell plates), aerospace and even MIM and CIM cases for smartphones. However, the technology’s prospects could be improved further by developing and using affordable powders. This would mean developing technology where expensive fine spherical powders could be replaced with cheaper fine irregular shaped powder, or even a coarser spherical powder.